Fintech solutions have revolutionized how businesses manage their finances, offering innovative and efficient ways to handle everything from payments to expense management.

Among the leading fintech players are Brex and Mercury, two platforms that have garnered significant attention for their unique offerings tailored to modern businesses.

This article aims to provide a detailed comparison of Brex and Mercury, helping you decide which platform best suits your business needs.

Company Overviews

Brex Overview

Founded in 2017, Brex quickly emerged as a game-changer in the fintech industry. Initially targeting startups, Brex offers corporate cards and cash management accounts designed to meet the dynamic needs of growing businesses.

Brex stands out with its focus on providing high credit limits, no personal guarantees, and a rewards program tailored for business expenses. The company’s mission is to help startups scale faster by providing them with financial tools that traditional banks often don’t offer.

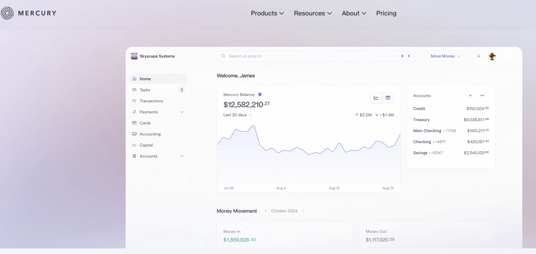

Mercury Overview

Conversely, Mercury was founded in 2019 and has positioned itself as the bank for startups. With a focus on simplicity and efficiency, Mercury offers business checking accounts, debit cards, and treasury services.

The platform is known for its user-friendly interface and seamless integration with various financial tools. Mercury’s primary audience includes startups and tech-forward companies looking for a modern banking solution that aligns with their innovative approach.

Account Setup and Ease of Use

Brex Account Setup

Setting up a Brex account is straightforward and can be completed online in minutes. The process involves providing basic business information, linking your business bank account, and verifying your identity.

Brex’s user interface is clean and intuitive, making it easy for users to navigate through the platform’s various features. The dashboard provides a comprehensive overview of your finances, including spending analytics and rewards tracking.

Mercury Account Setup

Similarly, Mercury offers a hassle-free account setup process that can be completed entirely online. After filling out an application with your business details, Mercury performs a quick verification process.

Once approved, you can start using your Mercury account immediately. The platform’s interface is sleek and modern, providing users with an easy-to-navigate dashboard that displays key financial metrics and account information.

Financial Products and Services

Brex Financial Products

Brex offers a range of financial products designed to help businesses manage their finances efficiently. The Brex corporate card is one of its flagship products, providing high credit limits and no personal guarantees.

Additionally, Brex offers cash management accounts that allow businesses to earn interest on their deposits while having easy access to funds. Brex also provides various credit and funding options tailored to the needs of startups and growing businesses.

Mercury Financial Products

Mercury’s primary offerings include business checking accounts and debit cards. The platform provides both virtual and physical debit cards, making it easy for businesses to manage expenses.

Mercury also offers treasury services, allowing businesses to invest excess cash in low-risk investment options. These products are designed to provide startups with a comprehensive banking solution that caters to their unique needs.

Fees and Pricing

Brex Fees

Brex has a transparent fee structure that is attractive to many businesses. There are no annual fees for the corporate card, and the platform does not charge foreign transaction fees.

Brex also offers competitive interchange rates, making it a cost-effective choice for businesses that frequently make international transactions. However, businesses should be aware of potential fees related to late payments and cash advances.

Mercury Fees

Mercury prides itself on offering a fee-free banking experience. There are no monthly maintenance fees, minimum balance requirements, or foreign transaction fees.

This makes Mercury an appealing choice for startups and small businesses looking to minimize banking costs. Additionally, Mercury does not charge fees for incoming or outgoing ACH transfers, further enhancing its cost-effectiveness.

Rewards and Benefits

Brex Rewards Program

Brex offers a robust rewards program that is tailored to business expenses. Users can earn points on every purchase, with higher reward rates for specific categories such as travel, dining, and software subscriptions.

These points can be redeemed for travel, statement credits, or transferred to Brex’s travel partners. The rewards program is designed to provide businesses with valuable benefits that align with their spending habits.

Mercury Benefits

While Mercury does not offer a traditional rewards program, it provides several benefits that appeal to startups. These include access to exclusive networking events, educational resources, and partnerships with other fintech companies.

Mercury’s focus on community and support helps startups connect with valuable resources and opportunities that can aid in their growth and success.

Integration and Compatibility

Brex Integrations

Brex integrates seamlessly with a variety of accounting and expense management tools, including QuickBooks, Xero, and Expensify. This makes it easy for businesses to sync their financial data and streamline their accounting processes.

Brex also offers API access, allowing businesses to build custom integrations that fit their specific needs.

Mercury Integrations

Mercury supports integrations with popular accounting platforms such as QuickBooks and Xero, as well as payment gateways like Stripe. These integrations help businesses manage their finances more efficiently by automating data entry and reducing the risk of errors.

Mercury’s API also allows for custom integrations, providing businesses with the flexibility to tailor the platform to their unique requirements.

Customer Support and Service

Brex Customer Support

Brex offers 24/7 customer support through various channels, including phone, email, and live chat. The company is known for its responsive and knowledgeable support team, which helps users resolve issues quickly.

Brex also provides a comprehensive help center with articles and tutorials to assist users in navigating the platform.

Mercury Customer Support

Mercury provides customer support through email and a detailed help center. While the support team is not available 24/7, users typically receive prompt and helpful responses to their inquiries.

Mercury’s help center includes a wealth of resources, including guides and FAQs, to help users make the most of the platform.

Security and Compliance

Brex Security Measures

Brex takes security seriously, employing industry-standard protocols to protect user data. The platform uses encryption, multi-factor authentication, and continuous monitoring to ensure the security of its users’ financial information.

Brex also complies with relevant regulations and standards, providing businesses with peace of mind regarding their data security.

Mercury Security Measures

Mercury also prioritizes security, utilizing advanced encryption and authentication methods to safeguard user data. The platform undergoes regular security audits and maintains compliance with industry standards.

Mercury’s commitment to security ensures that businesses can trust their financial information is well-protected.

Case Studies and User Experiences

Brex Case Studies

Brex has helped numerous businesses streamline their financial management and access vital funding.

For example, a tech startup was able to secure a high credit limit without a personal guarantee, enabling it to invest in growth initiatives without worrying about cash flow constraints. Testimonials from satisfied users highlight the platform’s ease of use and valuable rewards program.

Mercury Case Studies

Mercury has also made a significant impact on its users, particularly startups seeking a modern banking solution.

One startup leveraged Mercury’s fee-free banking and seamless integrations to reduce operational costs and improve financial efficiency. User testimonials emphasize Mercury’s user-friendly interface and supportive community.

Pros and Cons

Brex Pros and Cons

Pros:

- High credit limits and no personal guarantees.

- Robust rewards program.

- Seamless integrations with accounting and expense management tools.

Cons:

- Potential fees for late payments and cash advances.

- Limited to businesses with significant cash flow.

Mercury Pros and Cons

Pros:

- Fee-free banking experience.

- User-friendly interface and seamless integrations.

- Supportive community and access to resources.

Cons:

- No traditional rewards program.

- Customer support is not available 24/7.

Conclusion

Both Brex and Mercury offer valuable financial tools tailored to the needs of modern businesses.

Brex stands out with its high credit limits, rewards program, and robust integrations, making it an excellent choice for startups with significant cash flow and spending needs.

Mercury, on the other hand, provides a fee-free banking experience, a user-friendly interface, and a supportive community, making it ideal for startups and small businesses looking for a cost-effective and efficient banking solution.

Ultimately, the choice between Brex and Mercury depends on your business’s specific needs and priorities. By understanding the strengths and limitations of each platform, you can make an informed decision that best supports your financial goals and growth ambitions.

What’s your take on both these financial payment tools? Share your feedback with us at info@cloudmention.com